File Form 1099-MISC Online for 2023

Due Date to File Form 1099-MISC for 2023 Tax Year

Recipient Copies

January 31, 2024Paper Filing

February 28, 2024E-Filing

April 01, 2024Note: The due date is extended to February 15, 2024, if you are reporting payments in boxes 8 or 10.

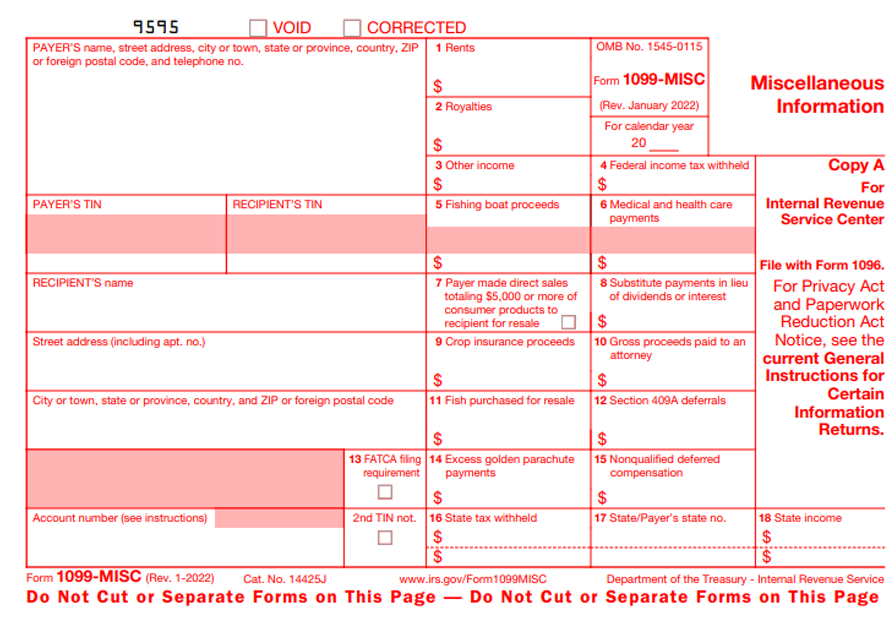

Form 1099-MISC - Miscellaneous Income

Form 1099-MISC is used to report miscellaneous income received during the tax year. If paid a minimum of $600 for rent, fishing boat proceeds, medical and health care payments, prizes, awards, and more are reported in form 1099 MISC. A copy of the 1099 Form must be sent to the recipient before the deadline.

Why 1099-MISC Online filing is Prefered?

Form 1099-MISC can be filed either through paper or electronic filing. By E-filing 1099-MISC, you can save time. Also, IRS suggests that filers switch to e-filing their tax returns for quick processing and instant approval.

If Electronically files your 1099 Form there is no need to submit form 1096 as it gets submitted automatically. Also, you will be instantly notified via email once the IRS receives your form!

Click here to learn more about Form 1099-MISC Filing.

What are the IRS changes to 1099 MISC for 2022?

Form 1099-MISC has undergone various changes over the past years. Up until the 2021 tax year, the FATCA Filing Requirement checkbox has been unnumbered. In the year 2022, the FATCA Filing Requirement check box has been numbered 13. Subsequently, old box 13 to 17 has been renumbered to 14 to 18 respectively.

Learn More about IRS Form 1099-MISC changes for the 2022 tax year.

1099misconline.com - Your Market Leading Form 1099-MISC Online Filing Solution

We have taken the time to develop a streamlined step-by-step e-filing process to help you instantly complete your form with our safe and secure

Form 1099 reporting software. You'll be able to quickly complete your form and transmit it directly to the IRS, so you can spend less time worrying about your taxes and more time on what really matters. Plus, our time-saving features make the entire process super easy!

For example, you can take advantage of our postal mailing feature to have to use mail hard copies of your forms to each of your recipients. Our bulk upload feature helps you save time by allowing you to upload all of your information at once and you can visit our print center to download, view, and print your completed forms at any time.

Visit https://www.taxbandits.com/1099-forms/efile-form-1099-misc-online/ to know more about the filing of IRS 1099-MISC Form.

Why are we the best 1099-MISC online filing option?

- 1099 State Filing supported

- Bulk Upload options available

- Print center and Postal Mailing

- Online Secure Portal

- Supports 1099 form Corrections

- Secure, Fast and Safe

- Now integrated with Xero and QuickBooks which makes e-filing fast

Information Required to E-File 1099-MISC

In order to e-file 1099-MISC you need to provide the following information:

- The payer information such as the name, EIN, and address.

- The recipient information, including the name EIN/SSN, and address.

- The federal information meaning miscellaneous incomes and federal tax withheld.

- The state filing information meaning the state income, payer state number, and state tax withheld.

Other Supported Forms

- Form 1099-NEC, Form 1099 K, MISC, INT, DIV, R, S, B, G and PATR

- Form 1095-B/C

- Form W-2, W-3

- Form 941, 941-PR, 941-SS

- Form 990-N, 990-EZ, 990, 990-PF & 1120-POL

- Form 8868, Form 8809

Get Your Free Fillable Form W-9!

TaxBandits’ Fillable W-9 solution allows users to complete and e-sign the W-9 form in minutes quickly, Our system performs basic data validations to ensure accuracy and error-free completion. W-9s are securely stored, allowing users to access, edit, or share them anytime.

Steps to File Form 1099-MISC Online

Filing Form 1099-MISC Online is quick and easy. Just refer to the following steps:

- Step 1: Create your free account with your email address and private password, then click "Form 1099-MISC".

- Step 2: Enter your payer information such as the name, EIN, and address.

- Step 3: Enter your recipient details, including the name, SSN/EIN, and address.

- Step 4: Provide your federal information for miscellaneous income.

- Step 5: Enter your state information and state taxes withheld for each applicable state.

- Step 6: Review your information, pay for your form, and transmit it directly to the IRS.

Get started with TaxBandits today to e-file Form 1099-MISC before the deadline and avoid any unnecessary Penalties

Form 1099-MISC Extension

Need more time to file Form 1099-MISC? Well then use Form 8809 to get 30 extra days!

By simply filing Form 8809 by your original tax deadline you will instantly receive an automatic 30-days filing extension for Form 1099-MISC.

Form 1099-MISC Penalties

If you fail to file 1099-MISC Form on time you will have penalties to face. The size of the penalty varies based on your organization's size and how late your return is. The penalty amount ranges from $60 to $630.

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request w9 form online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.